As business owners, we often focus on credit card security for our customers and clients first and foremost. However, it should be equally as important to protect the business credit card that is used to make purchases for the company. Here are some tips and tricks to keep this incredibly important asset safe and secure.

Encrypt Everything

Business credit card encryption is an essential practice in protecting your credit card information from hackers and thieves. What is credit card encryption and how do you put it into practice?

Credit card encryption reduces the likelihood of your card information being stolen by making it impossible to access the information on the card without the corresponding encryption key. Card issuers often have some form of encryption in place, so it’s important to make sure that your credit card does to ensure company card protection.

The first of these encryption methods is the magnetic stripe on the back of your business credit card. This is a less secure method when relied on alone. Other forms of encryption are PIN and chip cards, and smart electronic chip cards. Both of which make it much more difficult for information to be accessed by anyone without authorization.

Be sure to use credit card swipe alternatives whenever possible like chip insertion, tap-to-pay, or mobile wallets. Also, when using your card online, make sure that there HTTPS appears in the URL, as this means the site is secure.

Remain Vigilant

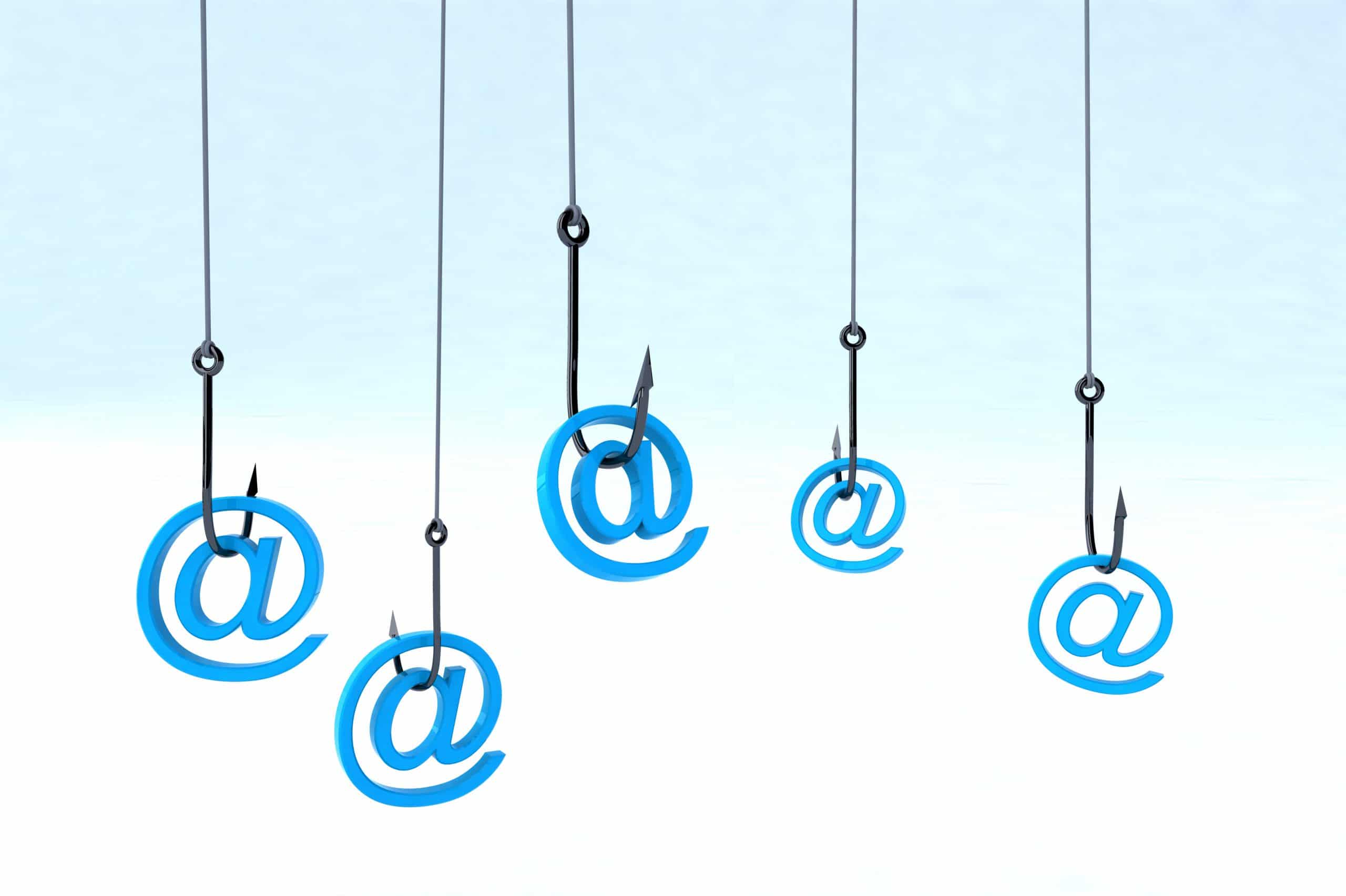

There are countless methods that hackers can use to steal your business’s credit card info, so it’s important to be educated on them and always use caution when giving out information. Cybercriminals often conduct phishing scams, where they pose as a vendor and attempt to confirm that they have your correct payment information on file.

Another common scam is credit card skimming. This is where an existing card reader, like at an ATM or gas pump, is used to steal information. Keep an eye out for these tactics and don’t conduct transactions where something looks or feels off. Your intuition is often correct in these situations!

Put Restrictions in Place for your Team

There should be a limit placed on the people who have access to your organization’s credit card to ensure company card protection. You should also place a reasonable cap on the card balance, which can help greatly in reducing the amount of damage that could be done if the information were to be stolen.

How to Deal with Fraud if it Happens

While preventative measures are a must, all the security in the world can sometimes still not fight off fraud. So, it’s important to know how to deal with it before it actually happens.

If credit card fraud occurs, the first step is always to report the issue to your card company and shut off the card so the scammer cannot use it any more than they already have. Once you have done this, file a local police report and contact the federal trade commission to submit a complaint.

Every Element of Your Business Needs to Be Secure

There are countless variables to take into consideration when it comes to your business’s credit card security. We can enhance your defense system with our comprehensive security solutions. To learn more, reach out to us at 954.474.2204.