MASTER Your Multi-Cloud Strategy: 7 Critical Solutions to the Chaos Costing Businesses Millions in 2025

Multi-cloud management requires platform-agnostic solutions that prevent vendor lock-in while delivering unified visibility across environments. You’ll gain strategic advantages through centralized dashboards that monitor performance, costs, and security simultaneously. Implementing consistent security controls, standardizing compliance requirements, and adopting strategic cost governance transforms cloud expenses into investments. Automating operations reduces human errors and strengthens your negotiating […]

The ONE Thing Every Successful MSP Should Do in 2025!

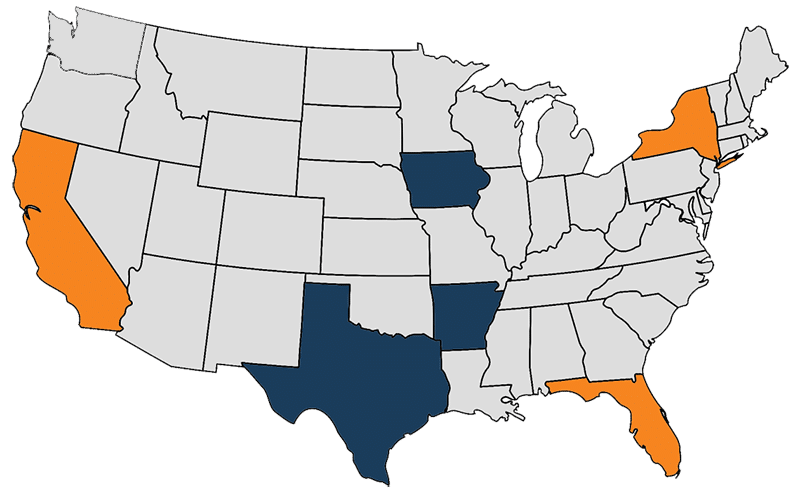

In 2025, WheelHouse IT will be at the forefront of successful MSP innovation, demonstrating that adopting advanced technologies is beneficial and essential. By integrating generative AI and harnessing the power of 5G and edge computing, we will enhance our service offerings and elevate client experiences. Automation will streamline our operations, allowing our team to focus […]

Lessons to Learn from the CrowdStrike Outage

The recent CrowdStrike outage serves as a significant wake-up call for businesses relying on cybersecurity solutions. CrowdStrike’s temporary service disruption, as one of the leading providers of endpoint security, underscores the importance of preparedness and resilience in the face of unexpected technological failures. This incident provides valuable insights into how businesses can strengthen their own […]

How MSPs Play a Crucial Role in Uptime via Network Redundancy

Network redundancy is a cornerstone for uninterrupted operations in today’s interconnected digital landscape. Imagine the implications of network downtime on your business—the potential loss of revenue, compromised productivity, and damaged reputation. Now, consider Managed Service Providers (MSPs)’ pivotal role in fortifying your network against such risks. As you navigate the intricate web of network reliability, […]

The Advantages of One: Why Partner with a Single IT Vendor

In today’s complex technological landscape, partnering with a single IT vendor like Wheelhouse IT can revolutionize your business operations. This approach offers a cohesive and tailored IT strategy that streamlines processes, enhances security, and provides cost-effective solutions, ultimately elevating your organization’s technological capabilities. Enhanced Security and Compliance with a Single IT Vendor Choosing one reliable […]